The 7th Pay Commission (7th CPC) was a major reform introduced by the Government of India to update the pay structure, allowances, and pensions of central government employees. Implemented in January 2016, it replaced the older pay bands and grade pay system with a simplified pay matrix table. With this, the minimum basic salary for central government employees was increased to ₹18,000 per month, and a new fitment factor of 2.57 was applied across all levels.

This reform impacted over 33 lakh central government employees, 14 lakh armed forces personnel, and 52 lakh pensioners, making it one of the most significant pay-related changes in Indian administrative history.

In this article, we’ll cover everything about the 7th Pay Commission pay matrix table, fitment factor, key features, benefits, allowances, pension changes, and what it means for government employees and pensioners.

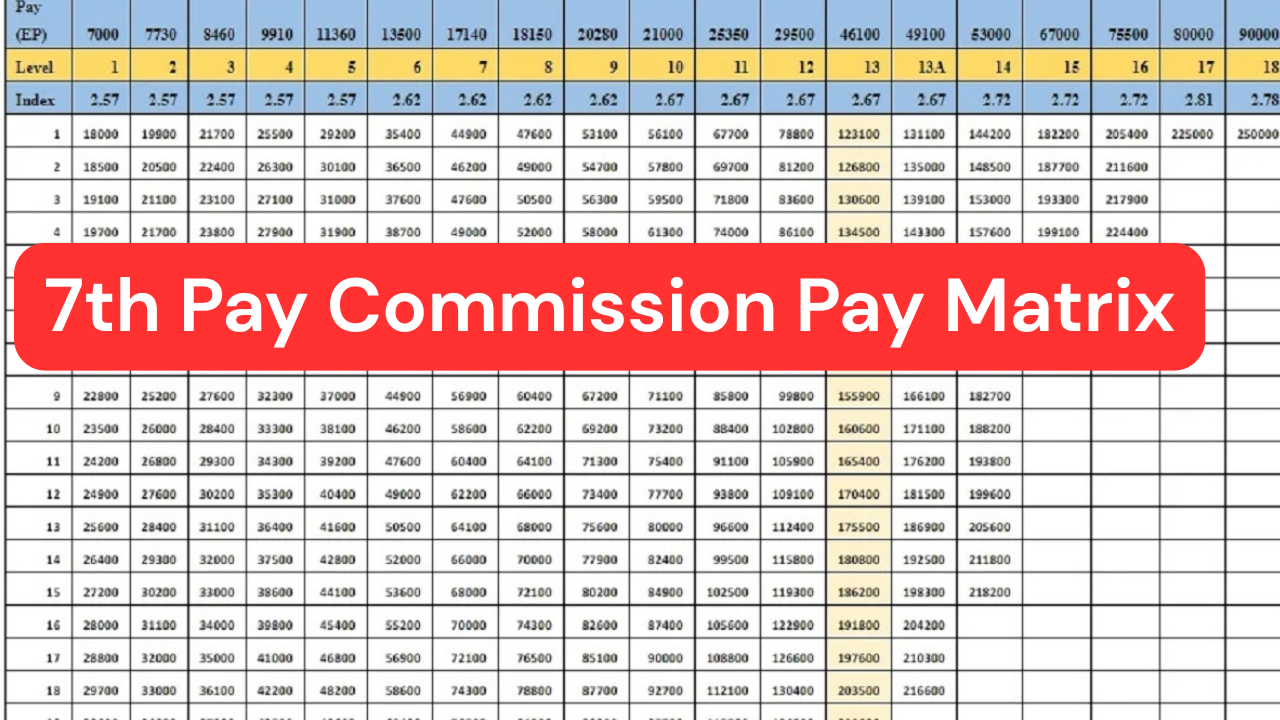

What Is the 7th Pay Commission Pay Matrix?

The 7th CPC pay matrix simplified the salary structure by merging pay bands and grade pay into a single transparent table.

- It consists of 19 pay levels, each representing different job grades.

- Each level allows 40 annual increments with a fixed 3% yearly increase.

- The structure aligns with 15th ILC norms, ensuring fairness across civil, defence, and other government employees.

This system makes it easier for employees to understand their career progression and salary growth compared to the older complex system.

Also read: List of Central Pay Commissions in India: 1st to 8th CPC Salary & Pension Hikes!

Benefits of the 7th Pay Commission Pay Matrix

The 7th CPC pay matrix brought several advantages for employees and administration alike:

- Transparency: Salary levels are clearly defined, reducing confusion.

- Simplification: Removed the need for manual calculations of grade pay.

- Uniformity: Applied across all services including civil, defence, and military.

- Fairness: Addressed disparities between pay bands like PB-3 and PB-4.

- Ease of Promotion: Clear structure for annual increments and career progression.

- Streamlined Administration: Reduced errors and made pension calculation simpler.

Entry-Level Pay in 7th Pay Commission

Every central government employee under the 7th CPC became eligible for a minimum monthly salary of ₹18,000. This was a substantial increase from the ₹7,000 minimum salary under the 6th CPC.

Fitment Factor in the 7th Pay Commission

The fitment factor (2.57) is the multiplier used to calculate the revised basic salary from the 6th CPC to the 7th CPC.

For example:

If an employee’s basic pay under the 6th CPC was ₹10,000, under the 7th CPC it becomes:

₹10,000 × 2.57 = ₹25,700

This factor ensured a uniform hike across all pay levels. Pensioners also benefited, as pensions were revised using the same fitment factor.

7th Pay Commission Pay Matrix Table

The table below shows how the grade pay system (6th CPC) transitioned into the new pay levels (7th CPC):

| Existing Pay Band | Grade Pay | Category | New Level |

| PB-1 | 1800 | Civil | Level 1 |

| PB-1 | 1900 | Civil | Level 2 |

| PB-1 | 2000 | Civil/Defence | Level 3 |

| PB-1 | 2400 | Civil | Level 4 |

| PB-1 | 2800 | Civil/Defence | Level 5 |

| PB-2 | 4200 | Civil/Defence | Level 6 |

| PB-2 | 4600 | Civil/Defence | Level 7 |

| PB-2 | 4800 | Civil/Defence | Level 8 |

| PB-2 | 5400 | Civil | Level 9 |

| PB-3 | 6600 | Civil/Defence | Level 11 |

| PB-4 | 8700 | Civil/Defence | Level 13 |

| Apex | – | Cabinet Secretary/Defence Chiefs | Level 18 |

This rationalized system helped employees clearly identify their current pay level and career growth trajectory.

Features of the 7th Pay Commission

- Minimum Pay: ₹18,000

- Maximum Pay: ₹2,25,000 for senior officials

- Cabinet Secretary Pay: ₹2,50,000

- Fitment Factor: Uniform 2.57 multiplier across all levels

- Annual Increment: Fixed at 3% (same as 6th CPC)

- Performance Linked Pay: Introduced stricter benchmarks for promotions

- Military Service Pay (MSP): Revised for armed forces personnel

- Cadre Review: Group A officers to undergo systematic changes

Allowances Under 7th Pay Commission

The 7th CPC rationalized 196 allowances into 137, and 52 were abolished.

Key Allowances:

- House Rent Allowance (HRA): 10% to 30% of basic pay

- Transport Allowance: ₹3,200 for A1 cities, ₹1,600 for others

- Siachen Allowance: ₹31,500 for officers, ₹21,000 for JCO/ORs

- High Altitude Allowance: ₹11,200 to ₹14,000 per month

- Risk & Hardship Allowance: Separate structure for defence personnel

- Kit Maintenance Allowance: ₹400 per month for defence personnel

Medical Facilities

- Health Insurance Scheme for all central government employees

- CGHS empanelled hospitals extended facilities to pensioners

- Postal pensioners also brought under CGHS

Pension and Gratuity Revisions

- Pension Parity: Ensures old pensioners receive revised pensions similar to serving employees.

- Disability Pension: Slab-based system introduced.

- Death in Service Compensation: Revised to provide higher financial security to families.

- Gratuity Limit: Increased to ₹20 lakh (with provision to rise by 25% when DA increases by 50%).

Impact on Defence Personnel

The 7th CPC had a major impact on armed forces personnel.

- Military Service Pay (MSP):

- Officers: ₹15,500

Nursing Officers: ₹10,800

JCOs: ₹5,200

- Non-Combatants (Air Force): ₹3,600

- Officers: ₹15,500

- Special Allowances:

- Hard Area Allowance: 25% of basic pay or ₹6,750

High Altitude Allowance: ₹11,200 – ₹14,000

Special Forces Allowance: ₹9,000

- Modified Field Area Allowance: ₹1,600

- Hard Area Allowance: 25% of basic pay or ₹6,750

Conclusion

The 7th Pay Commission pay matrix table and fitment factor brought significant changes to India’s central government pay structure. With a minimum salary of ₹18,000, fitment factor of 2.57, rationalized allowances, revised pensions, and fair increments, it created a transparent and progressive pay system. For government employees, defence personnel, and pensioners, the 7th CPC has ensured financial security, parity, and clarity, while also simplifying administrative processes. As we look forward, the upcoming 8th Pay Commission will likely build on these reforms to address new economic challenges and employee expectations.

Also read: Central Government Employee Retirement Benefits in India: Pension, Gratuity & Perks Explained

FAQs

1. What is the 7th Pay Commission Pay Matrix?

The 7th Pay Commission Pay Matrix is a simplified salary structure for central government employees, merging pay bands and grade pay into 19 transparent pay levels with fixed annual increments.

2. What is the fitment factor in the 7th Pay Commission?

The fitment factor is a multiplier (2.57) used to calculate revised basic pay from the 6th CPC to the 7th CPC, ensuring uniform salary hikes across all pay levels.

3. What is the minimum salary under the 7th Pay Commission?

The minimum basic pay for central government employees under the 7th CPC is ₹18,000 per month.

4. How does the 7th Pay Commission affect allowances?

The 7th CPC rationalized 196 allowances into 137, abolished 52, and revised key allowances like HRA, Transport Allowance, and special defence allowances.

5. What is the maximum salary under the 7th Pay Commission?

The maximum basic pay is ₹2,25,000 for senior officials, while the Cabinet Secretary’s pay is ₹2,50,000 per month.

6. How are pensions calculated under the 7th Pay Commission?

Pensions are revised using the same fitment factor (2.57) as serving employees, ensuring parity for pensioners. Gratuity limits were also increased to ₹20 lakh.

7. What are the key allowances for defence personnel under the 7th CPC?

Defence personnel receive revised Military Service Pay (MSP), High Altitude Allowance, Siachen Allowance, Risk & Hardship Allowances, and Kit Maintenance Allowance.

8. How many pay levels are there in the 7th Pay Commission Pay Matrix?

There are 19 pay levels in the matrix, each offering up to 40 annual increments at a fixed 3% yearly increase.

9. How is the 7th Pay Commission better than the 6th CPC?

The 7th CPC provides a transparent, uniform, and simplified pay structure, removes calculation errors, ensures fairness across services, and improves career progression clarity.

10. When will the 8th Pay Commission be implemented?

While the 8th Pay Commission has not been announced yet, it is expected to build upon 7th CPC reforms to address new economic challenges and employee expectations.