8th Pay Commission Salary Hike 2026: The 8th Central Pay Commission (8th CPC) is one of the most awaited reforms for over 1.1 crore central government employees and pensioners in India. Ever since the news of its setup surfaced, the excitement has been unmatched. With inflation rising, living costs increasing, and employees demanding justice for their service, the 8th CPC brings hope, expectations, and financial relief, many are asking: How much will salary hike be under 8th Pay Commission? What is the fitment factor? When will it be implemented?

What is the 8th Pay Commission & Why It Matters for Government Employees

The Government of India sets up a Pay Commission approximately every 10 years to review:

- Basic pay of central government employees

- Allowances like Dearness Allowance (DA), House Rent Allowance (HRA), Travel Allowance (TA)

- Pensions and Dearness Relief (DR) for retirees

- Service conditions for better efficiency and employee morale

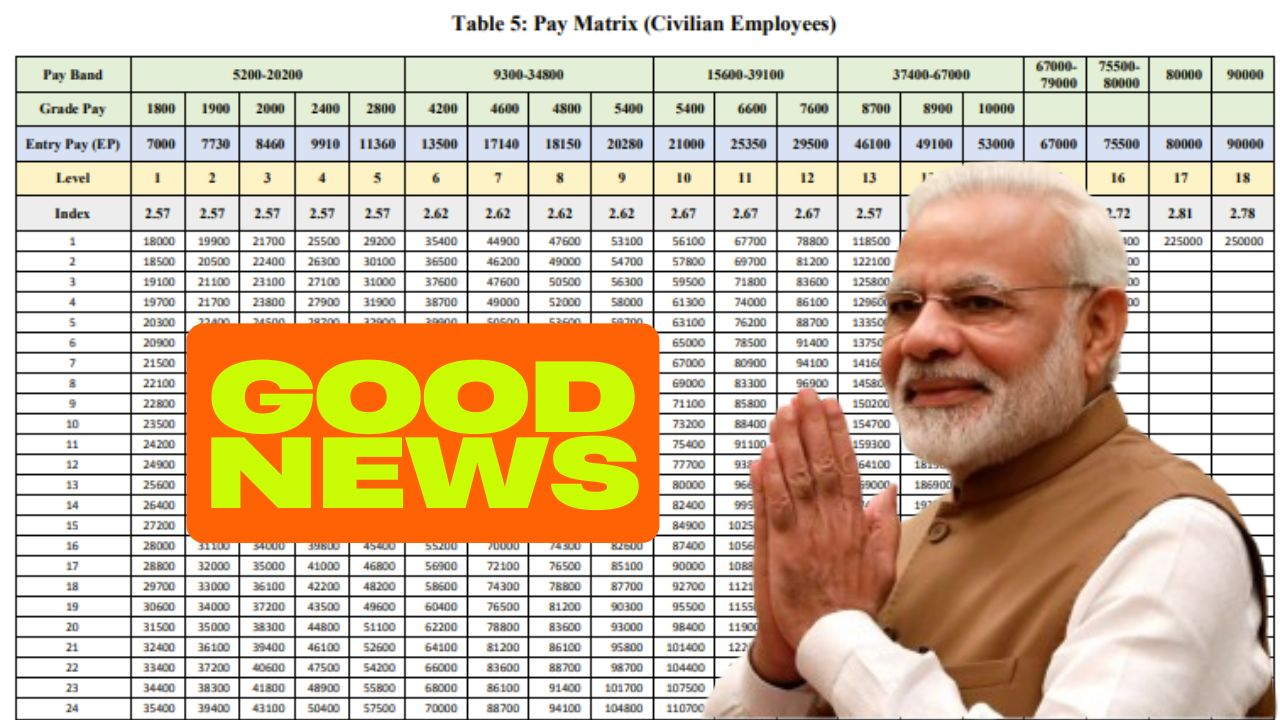

The 7th Pay Commission was implemented from 1 January 2016. It replaced grade pay with the Pay Matrix system, which is still in use. Now, the 8th Pay Commission is expected to come into effect from 1 January 2026, bringing major revisions in salary, allowances, and pensions.

Why it matters:

- More than 1 crore families will be directly affected

- It will boost employee morale and motivation

- Pensioners will get higher financial security

- It will help offset rising inflation and cost of living

Also read: 8th Pay Commission Salary Hike, Fitment Factor (Expected) & Implementation Date

8th Pay Commission Salary Hike 2026: What Employees Can Expect

One of the most common questions is: “How much salary hike will we get in the 8th Pay Commission?”

Different reports and expert estimates suggest a wide range of increases.

Projected Salary Hike Under 8th CPC

| Source / Report | Expected Salary Hike | Likely Fitment Factor | Remarks |

|---|---|---|---|

| Ambit Institutional Equities | ~30–34% | 1.83 – 2.46 | Based on inflation & government affordability |

| ClearTax Estimates | ~30–34% | 1.83 – 2.46 | Highlights DA reset and allowance restructuring |

| GoodReturns Report | ~80–180% (for lower levels) | 2.86 (optimistic) | Suggests minimum salary could rise to ₹51,480 |

With a fitment factor of 2.86, the minimum salary (currently ₹18,000) may rise to ₹51,480.

Key Terms You Should Know: Fitment Factor, Basic Pay, Allowances

To understand projections, it helps to know a few core terms:

- Fitment Factor: Multiplier applied to the current basic pay of employees to arrive at the revised basic pay under 8th CPC. A crucial component determining how much increase in salary and pension one will see.

- Basic Pay / Pay Matrix Level: The level (1, 2, 3 … etc.) which corresponds to current basic pay under 7th CPC. Revised basic pay will be calculated level-wise.

- Allowances: Components like Dearness Allowance (DA), House Rent Allowance (HRA), Travel Allowance (TA), etc. Many allowances are defined as a percentage of basic pay or fixed slabs. Under 8th CPC, these are expected to be recalculated.

- Pension Hike / Pension Revision: Pensioners also get benefit because pension is linked to basic pay and DA, etc. Expected increases apply to retirees as well.

Expected Salary Hike 2026: Projections & Ranges

Based on recent reports from data firms, financial analysts, and media sources, here are the projections for salary increase under 8th Pay Commission.

8th Pay Commission Fitment Factor Explained

The fitment factor is the multiplier applied to your existing basic pay to calculate the revised pay.

For example:

- Fitment Factor 1.83 → ~30% hike

- Fitment Factor 2.46 → ~40–50% hike

- Fitment Factor 2.86 (optimistic) → ~80–180% hike (especially for lower levels)

Sample Salary Projection Under Different Fitment Factors

| Pay Matrix Level | 7th CPC Basic Pay | With Fitment 1.83 | With Fitment 2.46 | With Fitment 2.86 |

|---|---|---|---|---|

| Level 1 | ₹18,000 | ₹32,940 | ₹44,280 | ₹51,480 |

| Level 2 | ₹19,900 | ₹36,417 | ₹48,974 | ₹56,914 |

| Level 4 | ₹25,500 | ₹46,665 | ₹62,850 | ₹72,930 |

| Level 5 | ₹29,200 | ₹53,416 | ₹71,920 | ₹83,512 |

8th Pay Commission Pension Revision 2026

The pension hike under 8th CPC will mirror salary revisions since pensions are linked to basic pay + DA.

- Minimum pension (₹9,000 today) may rise to ₹25,740 (with fitment factor 2.86).

- Family pensioners will also benefit.

- Dearness Relief (DR) will be reset and revised along with DA.

For retirees, this means dignity, stability, and better medical affordability.

Also read: 7th Pay Commission Revised Pension | Pension Calculation Guide

8th Pay Commission Allowances: DA, HRA & Other Benefits

Dearness Allowance (DA) Reset

- Under 8th CPC, DA will be reset to zero in Jan 2026.

- It will again start increasing by 2 times a year (Jan & July) based on inflation.

- DA may also be merged with basic pay partly.

House Rent Allowance (HRA)

- HRA will rise automatically as it is a percentage of basic pay.

- X, Y, Z cities may be reclassified for fairer housing cost distribution.

Travel Allowance (TA) & Medical Benefits

- TA slabs will increase in line with higher basic pay.

- Medical reimbursements and allowances will also be revised.

8th Pay Commission Salary Calculator

To estimate the revised salary using the 8th Pay Commission Salary Calculator is a useful tool for calculation. Below is a simplified calculation guide using the expected fitment factor of 3.0:

Steps to Calculate Gross Salary

Step 1: Check your basic pay under the 7th Pay Commission’s pay scale.

Step 2: Calculate Revised Basic Pay by using the formula:

Revised Basic Pay = Current Basic Pay × Fitment Factor (3.0)

Step 3: Calculate Dearness Allowance (DA), DA is a percentage of the revised basic pay. Assuming DA is 50%, calculate as:

DA = Revised Basic Pay × 0.50

Step 4: Include House Rent Allowance (HRA), which is a percentage of the revised basic pay, varying by city category:

Metro cities: 27%

Tier-2 cities: 20%

Tier-3 cities: 10%

Step 5: Use the applicable percentage, Add Travel Allowance (TA) which depends on the employee’s level and city classification.

HRA = Revised Basic Pay × City Percentage

Step 6: Calculate your gross salary by adding all components:

Gross Salary = Revised Basic Pay + DA + HRA + TA – Standard Deduction… Read more at: https://vajiramandravi.com/upsc-exam/8th-pay-commission/

8th Pay Commission Implementation Date, Arrears & Delays

- Effective Date: Most reports suggest that salary revisions under 8th Pay Commission should start from 1 January 2026.

- Notification & Terms of Reference (ToR): These are not finalized yet (as of the latest reports). The government is expected to define ToR including what allowances will change, how to treat DA, fitment factor etc.

- Possibility of Delay: Some analysts observe potential delays, as the commission’s constitution, stakeholder consultations, and financial implications must be settled before roll-out. Implementation may be “late 2026” or beyond in worst cases.

- Arrears: If implementation is delayed but back-dated to Jan 2026, employees may get arrears (past dues) once the revision is approved. This happened in earlier commissions.

How Much Will Government Employees Benefit?

- The benefit will depend heavily on current level (pay matrix), current basic salary, and the fitment factor chosen.

- Lower level employees (e.g., Level 1, Level 2) stand to gain more percentage-wise. Middle and higher levels will see higher absolute gains.

- Pensioners also benefit in comparable proportion. Minimum pension especially could increase by two-plus times if high fitment factor is adopted (e.g. 2.86).

One media report estimates nearly 1.1 crore employees and pensioners will benefit from the 8th Pay Commission’s salary hike.

8th Pay Commission Pay Matrix Table

| Pay Matrix Level | Basic Salary of 7th CPC | Basic Salary of 8th CPC (Expected) |

|---|---|---|

| Pay Matrix Level 1 | ₹18,000 | ₹21,060 |

| Pay Matrix Level 2 | ₹19,900 | ₹23,088 |

| Pay Matrix Level 3 | ₹21,700 | ₹25,410 |

| Pay Matrix Level 4 | ₹25,500 | ₹29,070 |

| Pay Matrix Level 5 | ₹29,200 | ₹33,048 |

| Pay Matrix Level 6 | ₹35,400 | ₹40,482 |

| Pay Matrix Level 7 | ₹44,900 | ₹51,273 |

| Pay Matrix Level 8 | ₹47,600 | ₹54,174 |

| Pay Matrix Level 9 | ₹53,100 | ₹60,093 |

| Pay Matrix Level 10 | ₹56,100 | ₹63,249 |

| Pay Matrix Level 11 | ₹67,700 | ₹76,617 |

| Pay Matrix Level 12 | ₹78,800 | ₹89,244 |

| Pay Matrix Level 13 | ₹1,23,100 | ₹1,47,741 |

| Pay Matrix Level 13-A | ₹1,31,100 | ₹1,57,170 |

| Pay Matrix Level 14 | ₹1,44,200 | ₹1,72,140 |

| Pay Matrix Level 15 | ₹1,82,200 | ₹2,17,476 |

| Pay Matrix Level 16 | ₹2,05,400 | ₹2,45,364 |

| Pay Matrix Level 17 | ₹2.25 lakh | ₹2.70 lakh |

| Pay Matrix Level 18 | ₹2.50 lakh | ₹3.0 lakh |

Projected Numbers: Sample Salary Increase Based on Fitment Factor Scenarios

Using realistic fitment factor options, here are sample basic pay increases (only basic pay, not gross including allowances):

These projections help you understand how salary hike works for different levels. The actual net increase (take-home) will depend on allowances, deductions, tax etc.

Also read: 7th Pay Commission Pay Matrix & Fitment Factor: Complete Guide

Possible Challenges & Considerations

While expectations are high, there are several factors that may limit or affect the final benefit:

- Government Budget Constraints: Large hikes and pension revisions mean heavy fiscal burden. The finance ministry has to assess how much the exchequer can sustain.

- Fitment Factor Negotiations: Unions may demand higher (e.g. 2.86 or more), while government may propose lower to control costs. The final factor may end up in middle.

- Allowance Rationalization: Some allowances may be merged or removed. Sometimes revising allowances reduces or eliminates some of the benefit felt by gross salary increases if allowance cuts offset gains.

- DA Reset Effects: Resetting DA to zero may reduce immediate apparent gains in salary for many even if basic pay increases. The effective take-home depends on how DA and other allowances are structured post-revision.

- Delayed Implementation & Arrears: If the 8th CPC is delayed (for example in notification or final approval), employees may have to wait long for benefits and arrears.

- Inflation & Cost of Living: If inflation is too high, the hike may still feel insufficient for real cost increases (housing, food, medical).

What Employees Should Do Now

To prepare and manage expectations, government employees & pensioners should do the following:

- Know your current Basic Pay and Pay Level: This is essential because the revision will be applied on that.

- Estimate your salary hike under various fitment factor scenarios: Use simple calculators or examples (as above) to see what your new basic pay might be at, say, factor 1.83, 2.46, 2.86.

- Consider gross salary including allowances: Check how HRA, DA, TA etc. will change when basic increases. Also consider deductions and tax implications.

- Keep track of announcements: Follow government releases, Ministry of Personnel / DOP&T, Joint Consultative Machinery (JCM) etc. Be alert for notifications of ToR, final fitment factor, effective date etc.

- Plan budgeting & finances accordingly: If salary increases, there may be higher tax, more responsibility. If delays happen, factor those too.

What Recent Media & Reports Are Saying

- ClearTax estimates that salary hikes under 8th Pay Commission will likely be 30-34%, using a fitment factor between 1.83 and 2.46.

- GoodReturns reports that many expect fitment factor ~2.86, which would produce more substantial increases (especially for lower levels).

- Zee News and other media have quoted minimum salary under 8th CPC possibly rising to ~₹51,480 (from ~₹18,000) under 2.86 factor.

- There are ongoing negotiations and ToR (Terms of Reference) finalization yet to happen. Employee bodies are pushing for effective date to be 1 Jan 2026.

Conclusion

The 8th Pay Commission Salary Hike 2026 represents a major opportunity for central government employees and pensioners to see considerable improvements in basic pay, allowances, and pension amounts. Projections range from ~30-34% hike in many cases, with some scenarios going up to ~2.86 fitment factor (which could double or more the basic pay for lower levels). Expect increases in HRA, DA, Travel Allowance, etc., but also watch out for how allowances are restructured, and how DA reset may affect net benefit.

If you are a government employee, begin estimating your possible salary hike, understand your pay level, and stay updated with official announcements. The final outcome will depend on fitment factor approved, Terms of Reference, and how allowances are recalculated.

Also read: List of Central Pay Commissions in India: 1st to 8th CPC Salary & Pension Hikes!

FAQ s

1. When will the 8th Pay Commission be implemented?

The 8th Pay Commission is expected to come into effect from 1 January 2026, subject to the government’s notification and approval. However, there may be delays depending on budgetary and procedural factors.

2. What is the expected salary hike under the 8th Pay Commission?

Most reports estimate a 30–34% hike in salaries for central government employees if the fitment factor is in the 1.83–2.46 range. Some projections with a fitment factor of 2.86 show even larger increases, especially at lower levels.

3. What will be the minimum basic pay after the 8th Pay Commission?

Under the optimistic scenario with a 2.86 fitment factor, the minimum basic pay may rise from ₹18,000 to around ₹51,480. This is one of the most searched queries among employees.

4. Will pensioners also benefit from the 8th Pay Commission?

Yes. Pensioners’ benefits are linked to basic pay and DA. With the new fitment factor, minimum pension could rise from ₹9,000 to around ₹25,740 in 2026.

5. What is the 8th Pay Commission fitment factor likely to be?

The government has not yet announced an official figure. Analysts expect it to be between 1.83 and 2.46, though employee unions are demanding 2.86 or higher to match inflation and cost of living.